Fractional ownership gives Africans foothold in luxury property business

More African investors seeking their own slice of tropical paradise are opting for fractional ownership as an affordable way to gain a foothold in the lucrative vacation real estate market.

Seth Onyango, bird story agency

Online real estate marketplaces for co-ownership of vacation homes and other prime units are springing up all over Africa as buyers seek to sidestep financial barriers in the property market

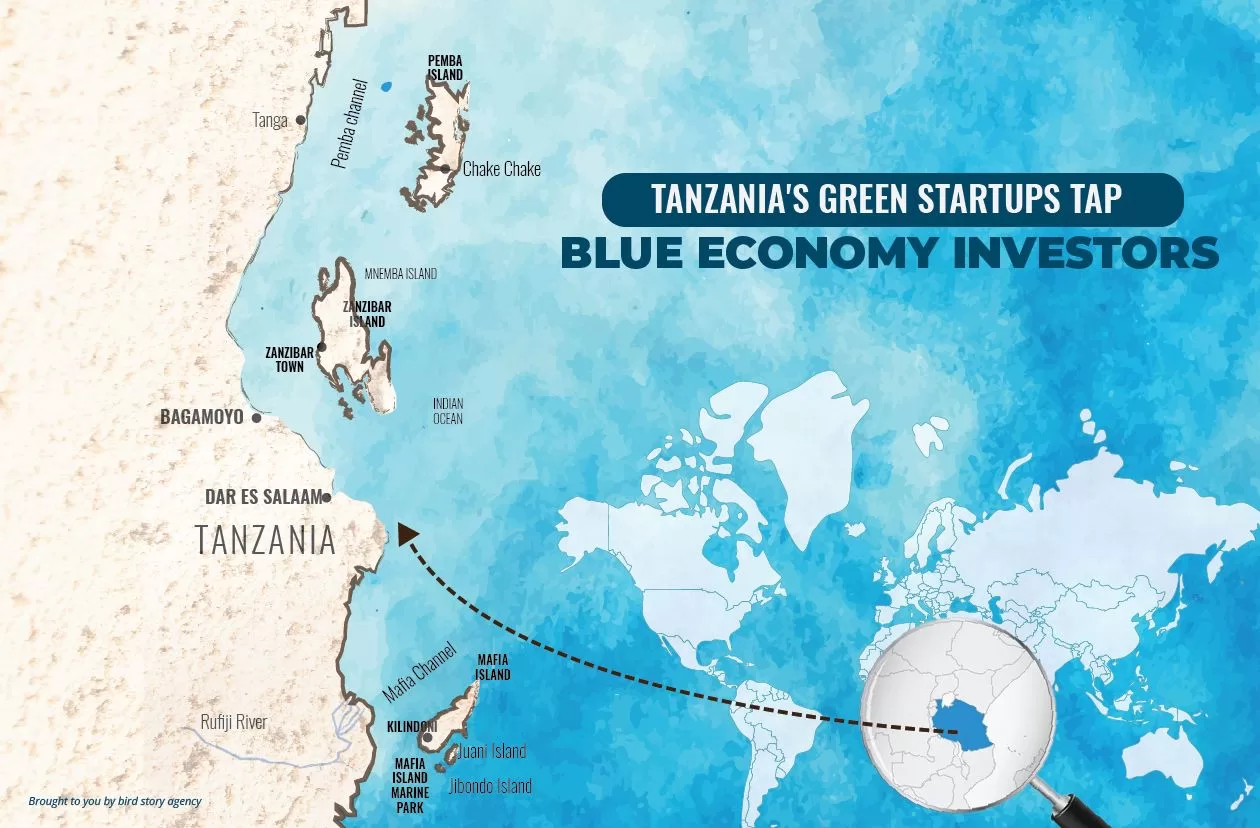

Kenya, Zanzibar, Mauritius, Mozambique and South Africa are some of the hottest markets for the split ownership model, where new properties are also now being built for multiple ownership.

While fractional ownership is also triggering acquisitions for residential property, the model is more popular among vacation home buyers.

In Mauritius, the market is heating up and both local and foreign investors seeking a slice of luxury “island life” are able to purchase property and obtain residency under the country’s fractional ownership policy.

According to the Economic Development Board (EDB), in Mauritius residential properties acquired by more than one non-citizen as part of a ‘split ownership’ will be eligible for residency, provided that each non-citizen’s investment exceeds $375,000.

Members of an extended family could buy into a single property under the fractional ownership policy and obtain more than one permanent residency permit. The 20-year residency is open to investors, retirees, professionals, self-employed entrepreneurs, and their families.

In Kenya, the popular coastal towns of Mombasa and Malindi are witnessing some of the biggest uptick in numbers of holiday homes bought through co-ownerships, ranging from villas and apartments, to hotels.

Big luxury hotel units such as the Great Rift Valley Lodge & Golf Resort, in Kenya’s lakeside town of Naivasha, are some of the known pioneers of the model.

Fractional ownership allows buyers to obtain a fraction of luxurious hotel property which then entitles them to a slice of profits the facility fetches every month and the right to use it at set periods annually.

Normally, the time one is allowed to spend at the facility is fixed, but owners can swap weeks with other fractional owners so that they all experience different seasons at the hotel in a given year.

Although pioneered more than a decade ago in Kenya, the scheme has only until recently gained traction in the country, fuelled by both mini and mega investors with an affinity for holiday homes.

Aberdare Cottages and Campsites boss Zack Gichane says the syndicated hotel ownership model is lucrative as it gets investors off to a cracking start.

“It gives hotel lovers an opportunity to own and enjoy a vacation home without the huge initial outlay associated with building a luxurious hotel facility,” he said.

Gichane who embraced the concept several years ago, says it is the future of property investment.

“When the concept of apartments was being introduced, people thought it is impossible to own a house on top of another…they wanted their homes firmly attached to the ground but with the time that has changed, apartments are now the most preferred shelters,” he said.

Gichane quips that Africa’s fractional ownership model is experiencing what he terms an “apartment moment” and the industry should expect more such model investments.

The cost of acquiring a fractional unit varies depending on size, with an investment of US$ 30,000 able to get one at least a unit with the cost subject to change as the industry continues getting positive reception in Africa.

In South Africa, dealers such as Timeshare S.A., which has been in the business for more than 15 years, are helping link prospective holiday home buyers to the listed property.

According to an analysis on Research Gate, the timeshare resort industry in South Africa is one of the largest on the continent and is distinctive in its reliance on domestic rather than international tourists.

“In terms of the distribution of resorts the key locational consideration in Africa parallels that found in other parts of the world, namely the positioning of resorts in areas of high natural amenity,” it reads in part.

“In the African context, this has meant clustering resorts in coastal beach areas and attractive mountain locations, as well as in the areas which afford opportunities for timeshare consumers to experience the African bush. Finally, of note in South Africa is the growth of large timeshare property developments at casino resorts, a development which parallels the experience of certain timeshare developments in the USA.”

The upsurge of fractional ownership models means Africa’s property market has taken a unique turn with investment groups also fast signing on to upcoming property development projects.

Investment groups comprising up to ten individuals are now joining forces to grab opportunities, particularly those featuring upcountry developments.

Given the amount of money required to invest in such projects, friends, colleagues and even cooperative members are joining hands to pool resources.

bird story agency