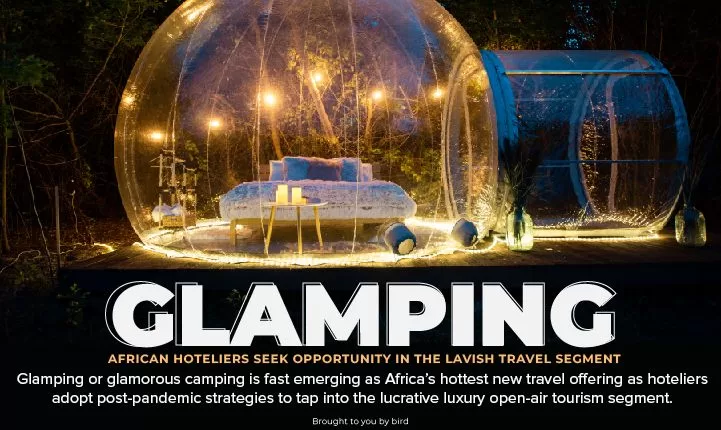

Glamping: African hoteliers seek opportunity in the lavish travel segment

Glamping or glamorous camping is fast emerging as Africa’s hottest new travel offering as hoteliers adopt post-pandemic strategies to tap into the lucrative luxury open-air tourism segment.

Seth Onyango, bird story agency

From enchanting luxury tents in the Agafay Desert in Morrocco to Saruni in the plains of Kenya’s Samburu, glamping getaways are becoming commonplace in Africa as more travellers seek new choices for their vacations.

Trends show that as more tourists become climate-conscious and inclined toward wellness, Safari tents are now the preferred option to immerse themselves in Africa’s wilderness.

For most travellers, luxury tented suites which come with five-star amenities offer novelty, a “digital detox” and quietness away from the hustle and bustle of city life.

As a result, tented camps are fast becoming some of the continent’s most sought-after accommodation options, eating into the share of traditional luxury city and coastal offerings that have long dominated the market.

Reports also show that more hoteliers are ditching concrete walls and high ceilings for bespoke safari-style tents laden with luxury touches, like free-standing bathtubs, jacuzzis, and fireplaces.

Guests fork out anywhere from US$ 400 and to more than US$ 2500 per night, depending on what is in the package.

Although glamping (glamorous camping), is not an entirely new concept in Africa’s hospitality market, it is striking a chord with more travellers, especially a younger demographic, thanks to social media platforms like Instagram and Tik Tok, which are now replete with stories of holidays “under the stars”.

Reports show the global glamping market size was valued at US$ 2.68 billion in 2021 and is projected to reach US$ 7.11 billion by 2031, growing at 10.5 percent per annum from 2022 to 2031, with Africa enjoying a significant share of that growth.

New investments are also expected to flow into Africa with the international hotel chain brand, Marriott announcing plans to launch its first luxury safari lodge in Africa: JW Marriott Masai Mara Lodge.

The luxury tented camp will be tucked away on the banks of Kenya’s Talek River, at the edge of the Masaai Mara National Reserve and is slated to open in February 2023.

The Lodge will have 20 luxury private tents, including an Executive Suite canvas-topped pavilion and two interconnecting canopied suites, ideal for families, each with a private deck overlooking the river. Facilities include a restaurant, lounge bar, spa, gym, studio, garden and an outdoor deck with fire pits.

“The signing of JW Masai Mara Lodge is a milestone in Marriott International’s growth in Africa as the company enters the luxury safari segment. This landmark project is in response to travellers’ growing desire for experiential offerings that enable them to build a deeper connection with their chosen destination. JW Marriott encourages guests to be mindful and present, which perfectly lends itself to meaningful safari holidays,” said Jerome Briet, Chief Development Officer, Europe, Middle East & Africa, Marriott International.

A report released by The Bench – a leading provider of hospitality events – in June shows Africa witnessing huge investments in the hospitality industry as disposable income rises, with luxury camping facilities also witnessing an uptick in the units being built.

As of Q1 2022, a record 42 global and regional (African) hotel brands reported on a pipeline of hotel and room developments totalling around 80,300 rooms in 447 hotels, in 42 of Africa’s 54 countries.

“Looking first at the number of rooms physically under construction, Morocco and Egypt are ahead of the pack, with 5,577 and 6,142 rooms respectively. They are followed by: Ethiopia, 3,871; Cape Verde, 3,016; Nigeria, 2,544; Kenya, 2,450; Algeria, 2,337; Tunisia, 2,280; South Africa, 1,948 and Senegal, 1,919. In Tunisia, Kenya and Morocco, over ¾ of the pipeline is “onsite”, whereas, in Egypt, 71% is just at the planning stage, reflecting its relatively “young” pipeline (a lot signed in the last 3 years),” The Bench said.

But while Nigeria has 45 per cent onsite, eight of the 15 hotels (with half of the total rooms) that have started construction have stalled, and the sites are closed.

“The picture changes somewhat when one looks at rooms being planned as well as those under construction. In this approach, Egypt is the star. It doesn’t just lead the country table, with over 21,000 rooms in 85 hotels in development, up 20 per cent on last year; but it is streaking ahead of the pack,” the Bench report reads in part.

“It has almost three times the number of new rooms planned as Morocco, and almost four times Nigeria, which was top of the table for many years.”

Increased global air traffic is also expected to deliver more tourists to Africa with safari and coastal tourism expected to gobble up most of the bookings.

Reports show tourism markets in Africa have been bouncing back as economies on the continent continue to relax COVID-19 rules to bolster their economies.

In outbound markets, tourists are also keen to leave their countries after an era of Covid lockdowns, many armed with vlogging devices and splurging on luxury tents.

According to an African Airlines Association (AFRAA) March 2022 update, many African airlines have opened international routes that did not exist pre-COVID-19, while others have re-opened most of their previous routes, in anticipation of a larger flow of tourists and business travellers.

“African airlines had reinstated approximately 80.8% of their pre-Covid international routes, though frequencies remain low,” said AFRAA.

Intra-African connectivity reached 80% of its pre-Covid level by December 2021.

UNWTO World Tourism Barometer data released in March 2022 shows international arrivals in Africa grew to 18.5 million in 2021 from 16.2 million in 2020. While this represents a 4.4% rise, it is still 76% lower than 2019 figures of 68.2 million. However, positive prospects in the airline industry have been recorded by International Air Transport Association (IATA) whose data shows African airlines had a 69.5% rise in February passenger traffic compared to 2021 figures.

bird story agency

![Blockchain offers to boost Africa’s carbon market [Graphics: Hope Mukami]](https://devage.co.zw/wp-content/uploads/2022/09/Blockchain_offers_to_boost_Africa_s_carbon_market_01-jpg.webp)