Power play: How access to regional power pools is changing the power game for Africa’s IPP’s

Namibia is not alone. Access to regional power pools across Africa provides public and private producers access to lucrative, power-hungry markets – a quick and efficient way for countries to boost energy capacity and benefit their populations.

Bonface Orucho, bird story agency

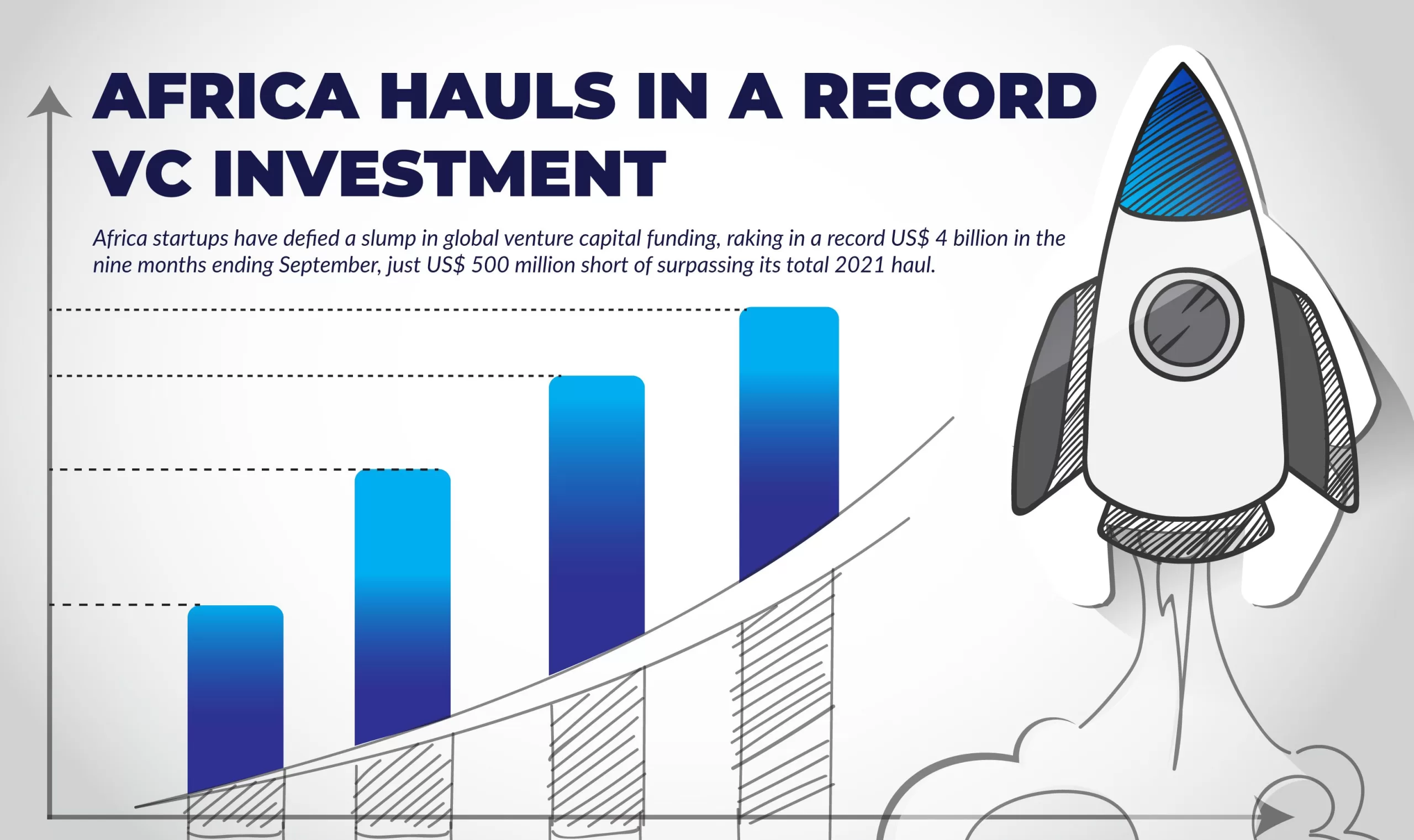

A 2019 change to Namibia’s power procurement legislation has seen a surge in solar and wind independent power producers – or IPPs – that could entirely transform the country’s power fortunes. From being an importer, the country is about to become an exporter with independent power producers transmitting power directly into the Southern Africa Power Pool regional grid; according to the country’s regulator, the Energy and Control Board.

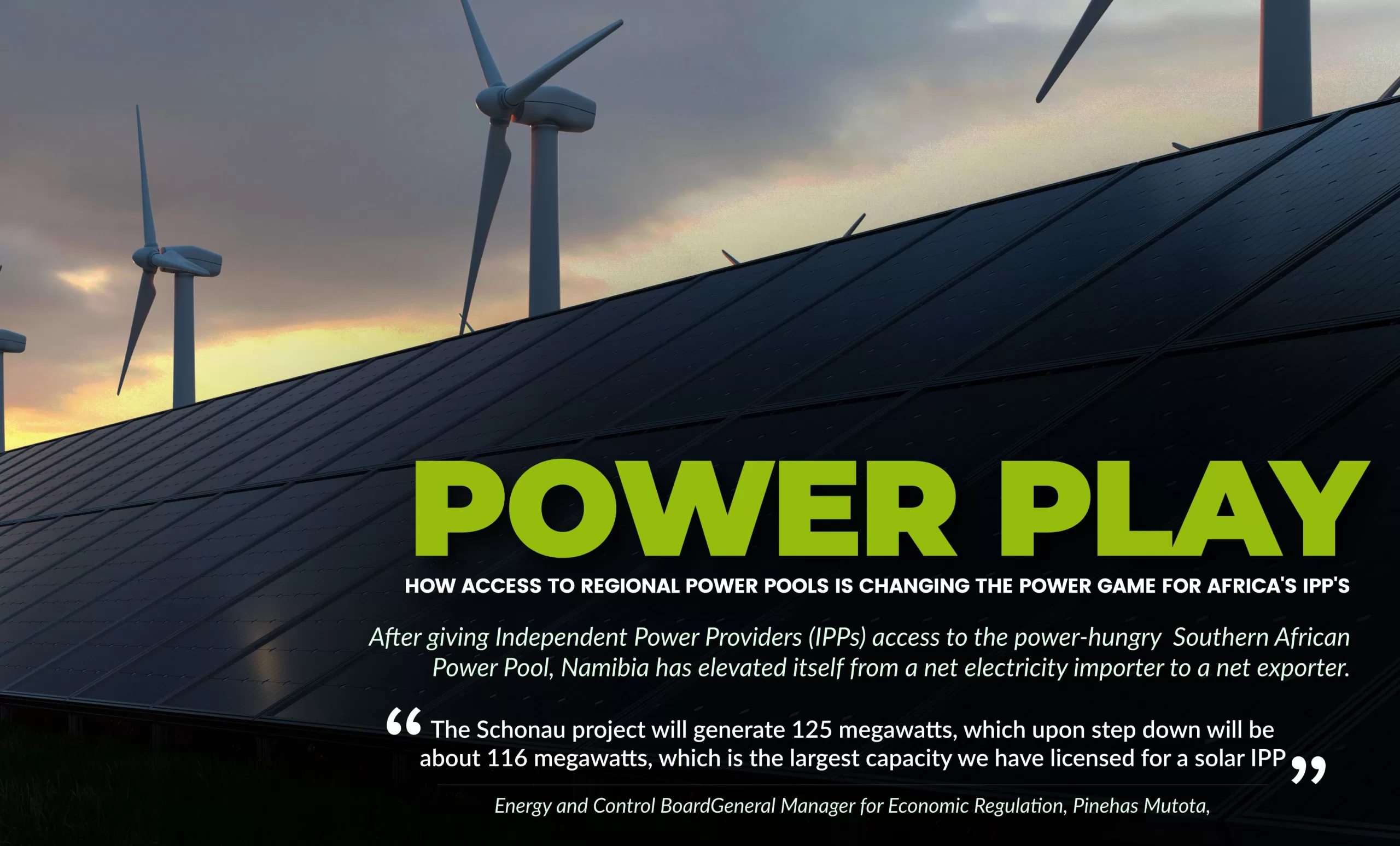

The board recently granted a license to Schonau Solar Plant, a subsidiary of renewable energy company Emesco. According to the ECB’s General Manager for Economic Regulation, Pinehas Mutota, the license provided to the Schonau facility will allow the independent producer to generate and export power via South Africa into the regional power pool.

“The Schonau project will generate 125 megawatts, which upon step down will be about 116 megawatts, which is the largest capacity we have licensed for a solar IPP,” Mutota explained.

“It is also impactful because it will transmit into the regional grid meaning we will also be bridging the deficits in neighbouring countries that are connected to the grid,” he added.

The liberalization of Namibia’s energy sector and access to the power-hungry Southern African Power Pool is elevating the country from a net electricity importer to a net exporter.

Other than the Schonau project, Namibia has also licensed or is in the process of licensing IPPs that together will offer another 300 megawatts (MW) to the regional grid.

Licensing renewable energy IPPs and having them contribute to the regional power pool will lower transmission costs in Namibia while availing more power for the region, explained Mutota.

“We are going to utilize our transmission network more because if for instance, we were pushing 100 units at a cost of 100USD, the IPPs will increase the units meaning we would do about 200 units at a lower cost,” he said.

While South Africa’s 58,095 MW of capacity dwarfs neighbouring Namibia’s 624 MW, decades of mismanagement have stripped South Africa of a significant capacity deficit – at times over 15,000MW – regularly plunging parts of the country into darkness.

With power utility Eskom scrambling to keep the lights on, the attraction for independent power companies able to feed into the regional pool is obvious.

“In Namibia, an injection of 100 MW or more into the grid may be excess for us yet the Southern Africa region has about 7000 MW power deficit yet we are interconnected, we can therefore export the surplus to them,” Mutota said.

A resolution to let more IPPs access the regional grid system was passed under the Southern African Development Community Centre for Renewable Energy and Energy Efficiency, SACREEE, in 2015.

According to Utsav Mulay, an Environmental Social and Governance (ESG) expert and electricity and clean energy researcher, the continent – especially the East Africa Power Pool – welcomes IPPs more than in the past. That’s providing an opportunity for renewables-based private power companies.

“All along, the challenge has been having the single monopolistic regulator in individual countries which made it hard for IPPs to thrive and have them support electricity demand at national-level and regional level,” Mulay explained.

A combination of market forces and technology is disrupting previously monopolistic markets, with IPPs now able to complement existing grids.

Mulay anticipates a greater challenge for regional power generation and distribution, with many IPPs offering renewable power based on solar and wind storage technology to ensure consistent supply.

“Solar and wind power, unlike geothermal, might not always be generated at all times meaning storage is important but the storage facilities are quite expensive,” he explained from Nairobi.

There is also a need to increase distribution, especially in countries such as Kenya, where excess power is generated but is not utilized effectively due to distribution challenges.

“Kenya generates about 3000 MW versus demand of 2400 MW. Having IPPs adding to the national grid in such a case would not be encouraged because the demand for power is not growing,” Mulay said.

“The surplus would however be very helpful in a country such as Ethiopia where the penetration rates are as low as 51%,” he added.

Ethiopia is gravitating towards IPPs to cover its shortage. It rolled out an ambitious solar power generation plan in 2017 dubbed the ‘Growth and Transformation Plan 2’, targeting the establishment of 13.7 GW of new, renewable energy capacity other than the hydroelectric option by 2025.

Last year, Masdar Clean Energy, an IPP, obtained the approval of the Ethiopian government to produce 500 MW of solar energy, adding to Enel Green Power which, since 2017, has been collaborating with the government to generate and transmit solar power to rural populations.

Mulay hailed regional power pools as they “would serve to manage the deficits while ensuring efficiency on a continental level.”

As Namibia sets the pace on its MSB framework, developments across the continent reveal the newfound reliance on solar and wind energy from IPPs.

The South African government, in September 2022, signed three wind power purchase agreements from Coleskop Wind Power, San Kraal Wind Power, and Phezukomoya Wind Power in an effort to cover its power deficits.

The three are from bid window 5 of the country’s Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) and constitute the first batch of a projected 25 projects that are meant to contribute more than 2500MW to the country’s national grid by the year-end. However, constant delays could push purchase agreements for many of the 25 projects into 2023.

South Africa’s Integrated Resource Plan, or IRP, suggests South Africa needs 20.6 GW of new solar and wind capacity by 2030 if the electricity demand in the country is to be met. Other neighbouring countries like Botswana have also encouraged the growth of independent suppliers to fill the southern Africa power vacuum, while further afield, north African countries are pushing independent providers to develop power supplies for export.

The operationalization of two solar plants in Zagora and Missour (both 80 MW), as well as the Solar PV plant of Tafilalet (120 MW) alongside the wind park in Oualidia ( 36 MW) all launched in 2021, facilitated Morocco’s export of 851 Ghw of electricity in 2021- an increase of more than 600% from the previous year.

“The success of solar and wind energy in complementing the main grid will be determined by governments’ willingness to incentivize businesses so as to increase power uptake. Financiers should also be open to supporting solar and water plant investments,” Mulay noted.

bird story agency