By Conrad Onyango, bird Africa Story Agency

Egypt is leading other African countries in mobilising for climate financing with billions of dollars worth of project pitches lined up for the UN’s COP 27 climate summit, scheduled for November.

Out of 140 ‘investible and bankable climate positive impact’ projects, Africa has settled on 19 with high regional impact and scope that will be marketed to rich nations, local and regional investors, governments and philanthropists for funding.

A projects review by Boston Consulting – the COP27 exclusive consulting partner – shows mixed funding models for all these projects- in the form of public and philanthropic grants, concessional loans, bonds and direct investments.

10 of these projects, covering just energy transition, food security, carbon credits, digital transformation, the Blue Economy, water and cities carry a funding ticket ranging between USD$ 120 million and US$ 10 billion.

At Cop26 last year, the UK, the US, the EU, Germany and France, announced a ground-breaking 8.5 billion US dollars package to help South Africa increase its share of renewable energy and accelerate the retirement of coal plants.

The climate finance needs are significant if Africa is to take its place amongst regions creating solutions to the climate emergency, but African leaders are determined to unlock funds. We break down the details of multi-billion pitches likely to be tabled at Cop 27

The proposed arrangement of this funding was in form of grants and concessional loans for up to five years, signalling the kind of agreements that may be preceding COP27.

Egyptian Minister of Foreign Affairs and COP27 President Designate, Sameh Shoukry said developing countries need adequacy and predictability of climate finance to achieve the goals of the Paris Agreement.

“There is an urgent need to unlock climate finance through a massive mobilization of public and private finance for climate actions solutions at the local, national and regional levels across the themes of climate action,” Shoukry said.

Host country Egypt will be the single largest beneficiary of the multi-billion-dollar mobilisation drive – with three of its projects taking its total funding ticket close to US$ 18 billion.

The biggest involves a US$ 10 billion fundraising to retire 17 inefficient fossil fuel power plants with a combined capacity of 7,500 MW and replace them with clean energy from wind and solar at a combined capacity of 11,300 MW. Once complete in 2035, it will lead to a reduction of 7.7 million tonnes of carbon emissions annually.

By 2025, the country plans to put up a 6 billion US dollar electric light rail to significantly cut down the use of buses for passenger and freight services across the country.

Over the next five years, the Egyptian government is also looking to develop six solar desalination plants – for US$ 600 million. The plants will gradually reduce dependence on freshwater supplies from the Nile – currently pressured by population growth and climate change.

“The project will increase adaptation to possible freshwater shortages due to reduced Nile flows as a result of climate change,” according to the report.

Starting next year, Egypt also plans to start an US$ 800 million crop adaptation program in the Nile Valley and Delta region – to increase the annual production of wheat, barley, maize and sorghum on 1.5 million hectares and boost climate resilience for 30 million rural citizens.

Since early August, the COP 27 presidency, in collaboration with among others UN Global Compact, the UN Development Programme and the United Nations Framework Convention on Climate Change (UNFCCC) has held five regional forums on Climate Initiatives to Finance Climate Action and the SDGs.

The forums bringing together government representatives, international organizations and multilateral and private financial institutions, as well as philanthropists, have covered Africa, Latin America and the Caribbean, Asia-Pacific, Western Asia and Europe regions.

Another US$ 10 billion fundraise targets the restoration of degraded land in 32 countries that have committed to restoring 128 million hectares of land. This will be funded through a mix of private finance, and public and philanthropy grants. Already US$ 1.4 billion has been committed to the project.

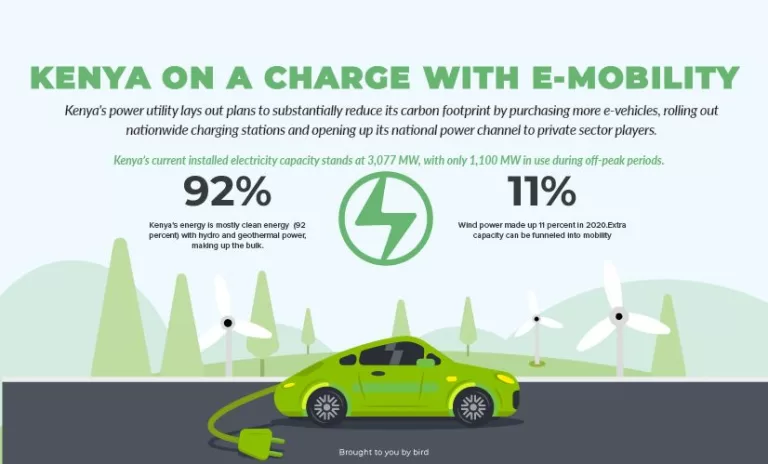

Nigeria’s big power project, the 3 GW Mambilla hydroelectric power project has also been lined up for financing, with a US$ 6 billion budget. Once complete, it will produce 5,457 GWh of renewable energy, pushing up the use of clean energy in the country to 30 per cent. A portion of that energy will be exported to ECOWAS – a regional political and economic union of fifteen countries located in West Africa.

A Blue Bond and debt-for-nature swap initiative, valued at US$ 1.5 billion US dollars and aimed at conserving 2 million square kilometres in the Western Indian Ocean has also been listed The initiative – currently in the design phase – involves purchasing the debt of developing countries in exchange for commitments to preserve blue natural environments.

The US$ 3 billion, 712-kilometer Lesotho-Botswana bulk water reservoir, under development in Lesotho’s lowlands requires a further US$ 500 million to complete, to bolster water security.

Another project expected to boost the supply and use of renewable energy in ECOWAS countries is the 150 MW regional solar power park project in Mali – with an annual production capacity of 498GWh – which requires 250 million dollars after feasibility studies are complete.

To further increase the supply of investment-ready clean projects in Comoros, Kenya, Madagascar, Mozambique, Tanzania and Seychelles ocean coastlines, a Blue Natural Capital Facility worth US$ 120 million will be marketed to investors.

As African government leaders continue to aggressively mobilise these funds, they are optimistic that COP 27 – already christened, ‘Africa’s COP’ – will unlock most of the numerous pledges made by private investors and governments from western nations.

Ghana’s President, Akufo Addo at a Virtual Climate Adaptation Summit in the Netherlands in early September said Africa can no longer wait for promises, calling for “a standalone implementation plan of the COP26-agreed doubling of adaptation funding by 2025”.

“It’s time to turn words into deeds and ambition into action,” said President Addo.

Western nations are yet to honour their 100 billion US dollars per year initial promise, due in 2020 and last year’s fresh pledges by some rich countries to double their adaptation finance contributions by 2025 are yet to become a reality.

Funding commitments have however begun flowing into the Africa Adaptation Acceleration Programme (AAAP) which intends to mobilise US$ 25 billion over five years to scale up and accelerate adaptation actions.

The African Development Bank is leading this front, with a commitment to provide half of the amount and the rest expected to be delivered by rich nations.

One project not mentioned in the Boston Consulting Report: a US$ 40 billion MoU signed between the Mauritania government and renewable energy company, CWP Global to develop a 30GW plant for low-cost green hydrogen in the West African nation. Several green hydrogen projects like Mauritania’s are in the works – from Egypt to Morocco to Namibia and South Africa, with major investment deals already announced and some deals are done.

At the Adaptation Summit, the United Kingdom (with US$ 23 million), Norway (with US$ 15 million), France (US$ 10 million) and Denmark (US$ 7 million) announced US$ 55 million in new funding contributions for the AAAP, to kick-start the mobilization of over US$ 5 billion in climate adaptation investments for Africa.

“Developed countries need to provide, by COP27, a clear roadmap of how and when they will deliver on this commitment,” said United Nations Deputy Secretary-General, Amina Mohammed.

Other leaders who have echoed these sentiments – and exuded confidence that Egypt’s COP27 will offer a chance to finally deliver on commitments – are the President of Senegal and Chairperson of the African Union, Macky Sall and the President of the Democratic Republic of the Congo, Felix Tshisekedi.

“Our time to act is coming to an end. Africa must prioritize adaptation. Africa needs to invest massively in adaptation and resilience,” Sall said, while Tshisekedi’s tone was even more urgent.

“With an African COP this year, we cannot miss out on a win for Africa on climate,” he said.

An analyst at Independent economic advisory firm, Oxford Economics, Jacques Nel, argues that while funding is critical, African leaders must be cautious of impending implications on the form the funding will take.

“We caution leaders to consider the long-term debt implications of such loans, and how this might affect the continent’s broader development agenda,” said Nel.

According to Nel, a holistic view of embedded infrastructure, developmental needs, available resources and fiscal positions will be needed to draw up the best roadmap to carbon neutrality.

bird story agency

![Blockchain offers to boost Africa’s carbon market [Graphics: Hope Mukami]](https://devage.co.zw/wp-content/uploads/2022/09/Blockchain_offers_to_boost_Africa_s_carbon_market_01-300x188.webp)

![Egypt, Algeria and Libya set to lead world's ‘green steel’ revolution [Graphics:Hope Mukami]](https://devage.co.zw/wp-content/uploads/2016/03/Egypt_Algeria_and_Libya_set_to_lead_world_s_green_steel_revolution_01-300x211.webp)

![Egypt, Algeria and Libya set to lead world's ‘green steel’ revolution [Graphics:Hope Mukami]](https://devage.co.zw/wp-content/uploads/2016/03/Egypt_Algeria_and_Libya_set_to_lead_world_s_green_steel_revolution_01-768x540.webp)

![Egypt, Algeria and Libya set to lead world's ‘green steel’ revolution [Graphics:Hope Mukami]](https://devage.co.zw/wp-content/uploads/2016/03/Egypt_Algeria_and_Libya_set_to_lead_world_s_green_steel_revolution_01-scaled.webp)

Leave a Reply

You must be logged in to post a comment.