By Conrad Onyango, bird story agency

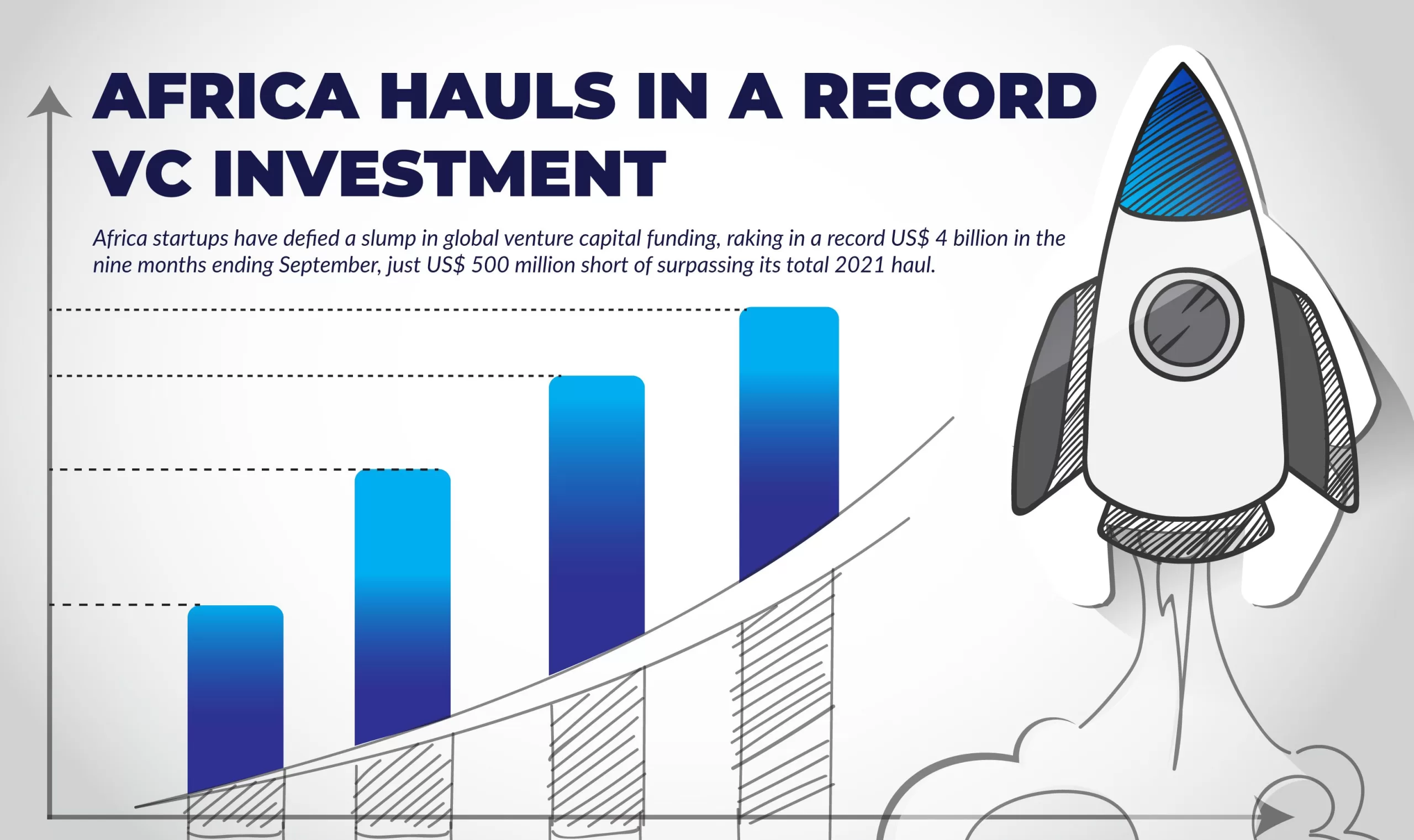

Investment into African tech startups that focus on mitigating climbing change is beginning to rise, following a global trend – albeit at much lower valuations than elsewhere.

Since the start of the year, green tech startups offering solutions that help countries keep to the Paris Agreement’s goal of limiting global warming to below 1.5 degrees Celsius have attracted growing investor interest.

Several venture capital firms are actively hunting startups while others are building up their war chests to capitalise on existing opportunities – including the take-over of successful and promising energy startups.

The recent acquisition of Ghana-based solar energy startup, PEG Africa, by UK-based power company, Bboxx is among the most significant deals in this vertical, so far.

PEG, with a pay-as-you-go solar home system, has a customer reach of one million. The company, already present in Senegal, Ghana, Mali and Ivory Coast, is served by over 500 employees in 100 centres. Reports value the deal at US$ 200 million.

Startups working to mitigate climate change in Africa have caught the eye of investors as venture funds flow into technology that could shape the future of energy on the continent.

“The agreement was closed on 6th September 2022. Financials have not been disclosed,” said Bboxx in a statement.

Following the deal, the two became the fastest-growing clean energy firms on the continent, with a combined customer base of 3.5 million across 10 African countries.

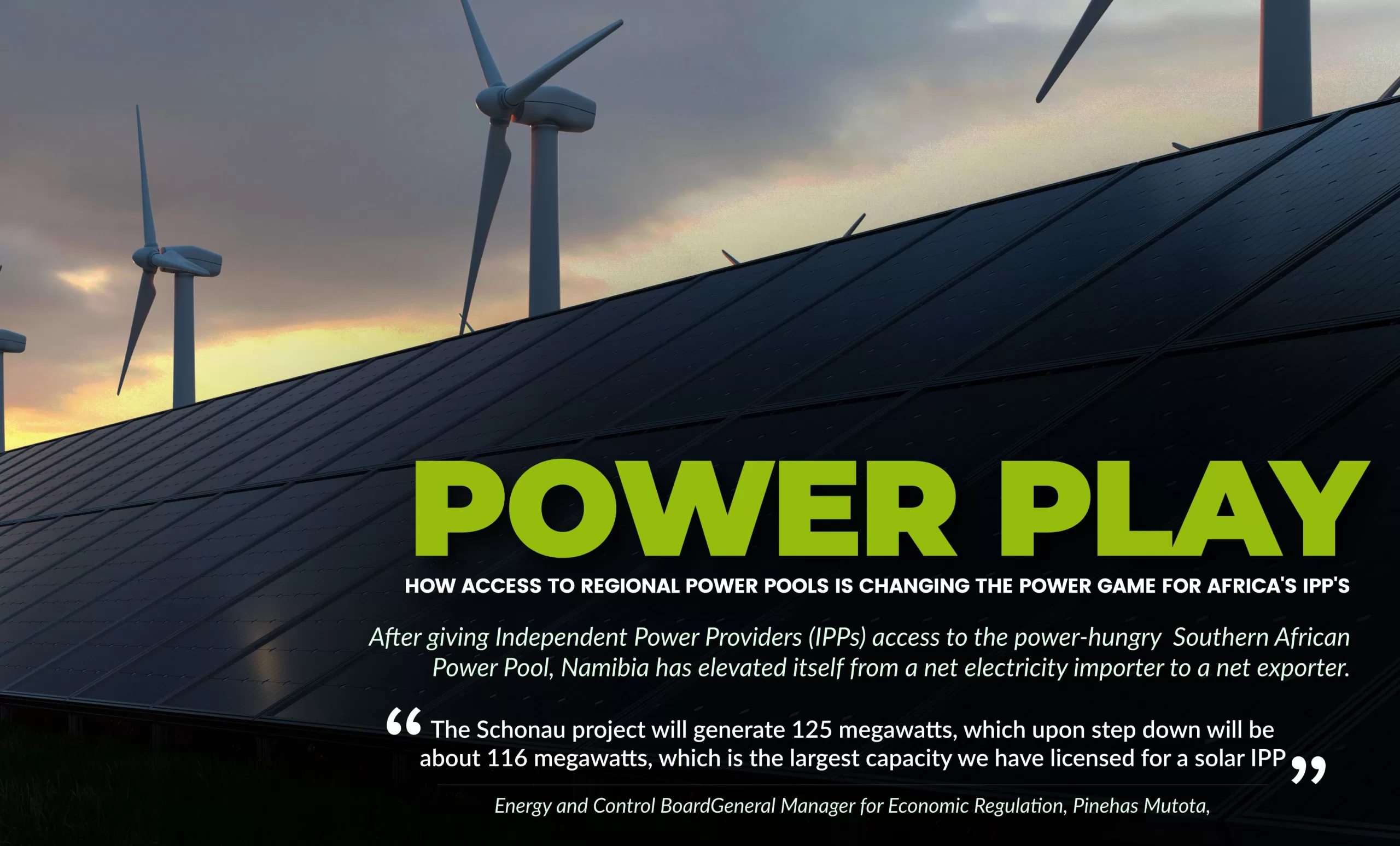

Canadian investor FinDev Canada pumped US$ 13 million into the Energy Entrepreneurs Growth Fund (EEGF) in January. EEGF invests in early and growth-stage energy startups in sub-Saharan Africa.

The fund – founded by oil marketer Shell – seeks to increase access to clean energy for households and off-grid businesses in the region.

Two months ago, Africa’s Climate Venture Builder, Persistent Energy, closed a US $ 10 million series C funding round to strengthen its team and scale climate activities in Africa. It said the funding has the potential to improve 2 million lives, create 6,000 green jobs and cut 700,000 tonnes of carbon emission.

“By leveraging powerful partnerships, we will be able to accelerate our most pioneering venture building investments, driving the transition to clean energy, promoting e-mobility and finding innovative business models and technological developments across the continent,” said Persistent Managing Partner, Tobias Ruckstuhl.

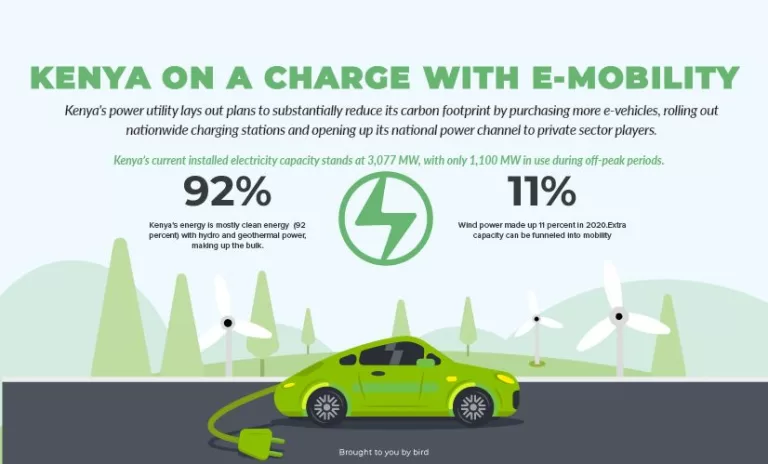

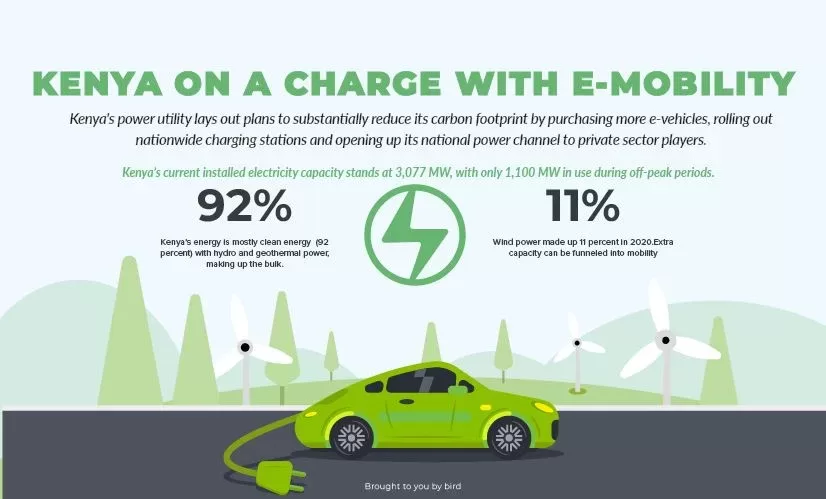

Over the last two decades, Persistent has engaged in 22 early-stage investments in pay-as-you-go- solar home systems, commercial and industrial solar, as well as e-mobility players including Kenya’s e-mobility startup, Ecobodaa.

Boston-based venture accelerator, Catalyst Fund has announced plans to begin funding Fintech and climate resilience startups in Africa starting October 2022.

“We are actively looking for early-stage startups that improve the resilience of underserved and climate-vulnerable communities in emerging markets. Our next cohort will kick off in October 2022,” announced the venture firm.

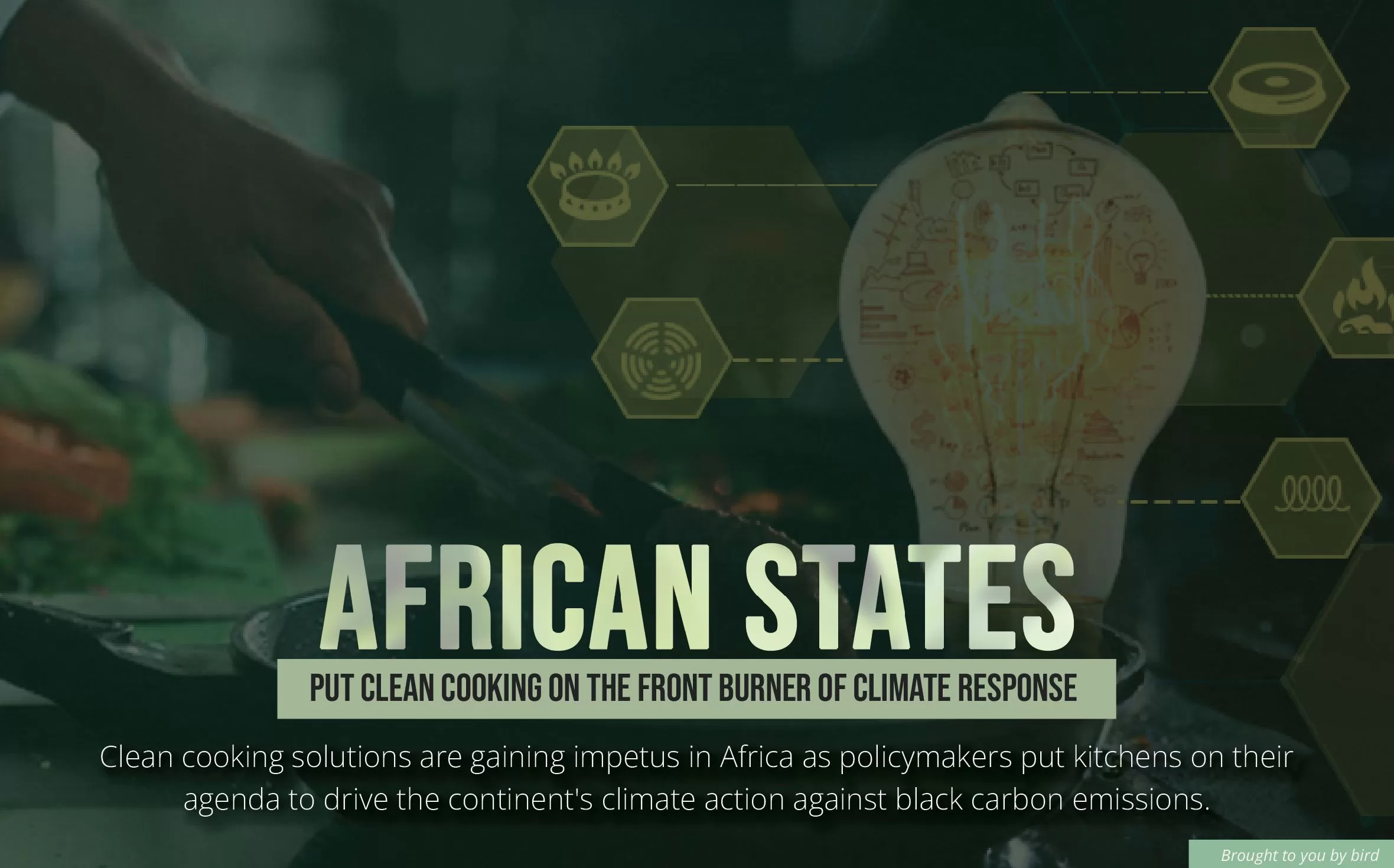

It is looking for startups offering solutions in recycling, sustainable agriculture, carbon credits and sustainable utilities like water management and clean energy. Already, the fund has received US $ 3.5 million from FSD Africa to support these initiatives.

Research firm Magnitt shows energy startups raised hundreds of millions of dollars in the first half of 2022. Africa energy startups drove 67 per cent of this capital.

A comparative report, State of Climate Tech 2021 by advisory firm PwC also highlights the growing attractiveness of the sector across the globe.

According to the report, investments in climate tech surged in the first half of 2021, to US$ 87.5 billion globally, from a low of US$ 28 billion in the second half of 2020.

“Though this area presents a major commercial opportunity, due to the inherent value associated with reducing emissions, there is still much work to be done to channel this investment appropriately,” said PwC researchers.

US climate tech firms raised the largest share (US$ 56.6billion), followed by Europe and China (US$ 18.3 billion and US$ 9 billion respectively). Most of this capital funding growth targeted electric vehicles.

bird story agency

![Egypt, Algeria and Libya set to lead world's ‘green steel’ revolution [Graphics:Hope Mukami]](https://devage.co.zw/wp-content/uploads/2016/03/Egypt_Algeria_and_Libya_set_to_lead_world_s_green_steel_revolution_01-300x211.webp)

![Egypt, Algeria and Libya set to lead world's ‘green steel’ revolution [Graphics:Hope Mukami]](https://devage.co.zw/wp-content/uploads/2016/03/Egypt_Algeria_and_Libya_set_to_lead_world_s_green_steel_revolution_01-768x540.webp)

![Egypt, Algeria and Libya set to lead world's ‘green steel’ revolution [Graphics:Hope Mukami]](https://devage.co.zw/wp-content/uploads/2016/03/Egypt_Algeria_and_Libya_set_to_lead_world_s_green_steel_revolution_01-scaled.webp)

Leave a Reply

You must be logged in to post a comment.